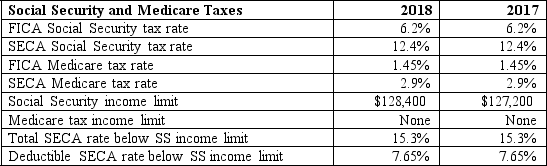

Jose worked at an architectural firm as an employee for the first four months of 2018 before he established his own business. He earned $53,300 at the architectural firm. His net income from his sole proprietorship was $78,000. Determine Jose's self-employment tax for 2018.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: Howard is a cash-basis, calendar-year taxpayer.He works

Q35: Which of the following is not taxable

Q44: George's flexible spending plan allows him to

Q47: Which of the following statements is correct?

A)

Q48: During 2018, Jones Corporation paid Joshua a

Q50: Carole, age 38, is single and works

Q53: Bill was awarded 3,000 options; each option

Q56: Warren has $62,400 of net income from

Q57: During 2018, Jackson Corporation paid Brittany a

Q59: Taxable compensation received from a business does

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents