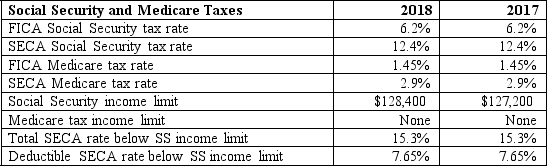

During 2018, Lee Corporation paid Nicole a salary of $118,000 and a bonus of $20,000. How much (rounded to the nearest dollar) is Lee Corporation required to withhold from Nicole's compensation for her share of FICA taxes?

A) $7,961

B) $2,001

C) $9,962

D) $10,557

Correct Answer:

Verified

Q23: Which of the following is a reason

Q27: James owns a sole proprietorship.James pays his

Q35: Which of the following is not taxable

Q37: Which of the following would not be

Q40: Carol owns a small curio shop that

Q41: Kerry became a bona fide resident of

Q47: Which of the following statements is correct?

A)

Q48: During 2018, Jones Corporation paid Joshua a

Q50: Carole, age 38, is single and works

Q53: Bill was awarded 3,000 options; each option

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents