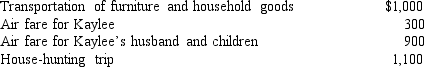

Kaylee is a member of the U.S. Armed Forces on active duty who moved because of a permanent change in station. She incurred the following moving expenses:  Kaylee's employer reimburses her $3,300 for the above expenses. Assuming that Kaylee meets all other requirements, how much income does Kaylee have as a result of this reimbursement of her moving expenses?

Kaylee's employer reimburses her $3,300 for the above expenses. Assuming that Kaylee meets all other requirements, how much income does Kaylee have as a result of this reimbursement of her moving expenses?

A) 0

B) $900

C) $1,100

D) $2,000

Correct Answer:

Verified

Q32: Tavis works for a company that sponsors

Q34: Jan has a company car for both

Q39: If an employee is reimbursed through an

Q42: Which of the following is a characteristic

Q51: Susie worked as a counselor at a

Q52: Elizabeth received the following benefits from her

Q58: Qualified deferred compensation plans have the following

Q65: Which of the following fringe benefit does

Q68: In 2013, Hu Corporation granted incentive stock

Q89: Tom, a calendar-year taxpayer, worked in Japan

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents