What is the maximum deductible contribution that Erick (age 32 and single) can make in 2018 to an Individual Retirement Account(s) if he earns $62,000 and is not covered by an employer-sponsored retirement plan?

A) $6,500 ($5,500 plus an extra $1,000 catch-up contribution) to a traditional IRA and zero to a Roth IRA.

B) $5,500 to a traditional IRA but only $1,500 additional to a Roth IRA

C) $5,500 to a traditional IRA

D) $4,500 to a traditional IRA due to the income limitation

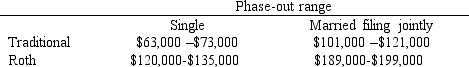

AGI Phase-Out Ranges for 2018 IRAs

Correct Answer:

Verified

Q49: Which type of retirement plan would not

Q59: Which of the following are characteristics of

Q65: All of the following are retirement plans

Q68: Henry is an employee of Argus Corporation.His

Q83: The contribution limit for a defined contribution

Q87: Carl, age 44, wants to contribute the

Q90: During 2018, Kyle has net income of

Q94: During 2018, Zach has net income from

Q95: Harris Corporation granted Tyler 1,000 stock appreciation

Q98: ABC Corporation awarded John 1,000 options in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents