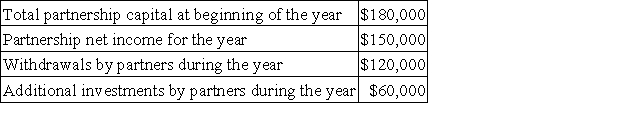

The following information is available on TGR Enterprises,a partnership,for the most recent fiscal year:  There are three partners in TGR Enterprises: Tracey,Gregory and Rodgers.At the end of the year,the partners' capital accounts were in the ratio of 2:1:2,respectively.Compute the ending capital balances of the three partners.

There are three partners in TGR Enterprises: Tracey,Gregory and Rodgers.At the end of the year,the partners' capital accounts were in the ratio of 2:1:2,respectively.Compute the ending capital balances of the three partners.

A) Tracey = $108,000;Gregory = $54,000;Rodgers = $108,000.

B) Tracey = $90,000;Gregory = $90,000;Rodgers = $90,000.

C) Tracey = $204,000;Gregory = $102,000;Rodgers = $204,000.

D) Tracey = $84,000;Gregory = $102,000;Rodgers = $84,000.

E) Tracey = $60,000;Gregory = $30,000;Rodgers = $60,000.

Correct Answer:

Verified

Q51: Which of the following statements is true?

A)Partners

Q53: Wheadon,Davis,and Singer formed a partnership with Wheadon

Q54: A partner can withdraw from a partnership

Q55: The following information is available on PDC

Q57: A bonus may be paid in all

Q58: Farmer and Taylor formed a partnership with

Q59: Harvey and Quick have decided to form

Q60: Wright,Bell,and Edison are partners and share income

Q61: Fontaine and Monroe are forming a partnership.Fontaine

Q73: When a partner is added to a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents