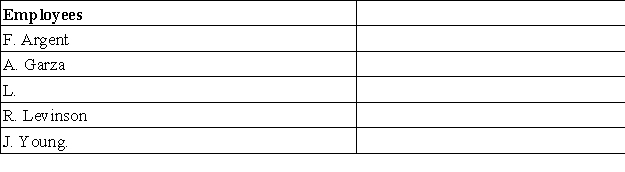

A company's employees had the following earnings records at the close of the current payroll period:  The company's payroll taxes expense on each employee's earnings includes: FICA Social Security taxes of 6.2% on the first $117,000 of earnings plus 1.45% FICA Medicare on all wages;0.6% federal unemployment taxes on the first $7,000;and 2.5% state unemployment taxes on the first $7,000.Compute the employer's total payroll taxes expense for the current pay period.

The company's payroll taxes expense on each employee's earnings includes: FICA Social Security taxes of 6.2% on the first $117,000 of earnings plus 1.45% FICA Medicare on all wages;0.6% federal unemployment taxes on the first $7,000;and 2.5% state unemployment taxes on the first $7,000.Compute the employer's total payroll taxes expense for the current pay period.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q104: On December 1,Watson Enterprises signed a $24,000,60-day,4%

Q105: An employer has an employee benefit package

Q107: A company's payroll for the week ended

Q110: A company sells its product subject to

Q111: An employee earns $9,450 for the current

Q112: On September 1,Knack Company signed a $50,000,90-day,5%

Q113: A company sells sofas with a 6-month

Q169: On September 15, SkateWorld borrowed $70,000 cash

Q170: Calculate the total amount of FICA withholding

Q174: On November 1, Casey's Snowboards signed a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents