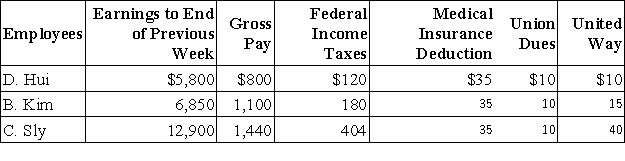

The payroll records of a company provided the following data for the current weekly pay period ended March 12.  Assume that the Social Security portion of the FICA taxes is 6.2% on the first $117,000 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Calculate the net pay for each employee.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $117,000 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Calculate the net pay for each employee.

Correct Answer:

Verified

Q131: Cardinal Company sells merchandise for $24,000 cash

Q135: Contingent liabilities are recorded in the accounts

Q140: Maturity date: September 17 (12 days in

Q181: _are probable future payments of assets

Q182: Drake Company pays its employees for two

Q188: Obligations due within one year or the

Q196: A _ shows the pay period dates,

Q197: _are amounts received in advance from

Q198: A _ is a potential obligation that

Q206: Companies with many employees often use a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents