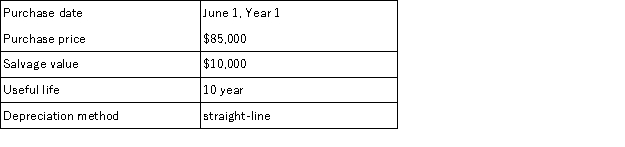

The following information is available on a depreciable asset owned by Mutual Savings Bank:  The asset's book value is $70,000 on June 1,Year 3.On that date,management determines that the asset's salvage value should be $5,000 rather than the original estimate of $10,000.Based on this information,the amount of depreciation expense the company should recognize during the last six months of Year 3 would be:

The asset's book value is $70,000 on June 1,Year 3.On that date,management determines that the asset's salvage value should be $5,000 rather than the original estimate of $10,000.Based on this information,the amount of depreciation expense the company should recognize during the last six months of Year 3 would be:

A) $8,125.00

B) $7,375.00

C) $4,062.50

D) $3,750.00

E) $7,812.50

Correct Answer:

Verified

Q9: The term,obsolescence,as it relates to the useful

Q10: Depreciation:

A)Measures the decline in market value of

Q11: Once the estimated depreciation expense for an

Q12: Peavey Enterprises purchased a depreciable asset for

Q14: The useful life of a plant asset

Q15: The relevant factors in computing depreciation do

Q16: A company used straight-line depreciation for an

Q17: When originally purchased,a vehicle costing $23,000 had

Q18: Peavey Enterprises purchased a depreciable asset for

Q67: A change in an accounting estimate is:

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents