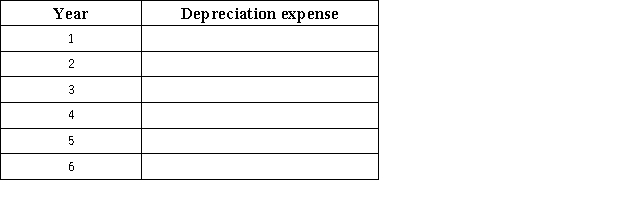

The Oberon Company purchased a delivery truck for $95,000 on January 2.The truck was estimated to have a $3,000 salvage value and a 4 year life.The truck was depreciated using the straight-line method.At the beginning of the third year,it was obvious that the truck's total useful life would be 6 years rather than 4,and the salvage at the end of the 6th year would be $1,500.Determine the depreciation expense for the truck for the 6 years of its life.

Correct Answer:

Verified

Year 1-Year 2 depreciatio...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q113: On January 1,2016,a company disposed of equipment

Q114: Schwartz Co.paid $780,000 cash to buy the

Q116: McClintock Co.had the following transactions involving plant

Q117: On January 1,Year 1,Naples purchased a computer

Q119: A company purchased and installed machinery on

Q120: On September 30 of the current year,a

Q121: A company needed a new building.It found

Q187: A building was purchased for $370,000 and

Q226: Record the following events and transactions for

Q240: A company paid $320,000 for equipment that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents