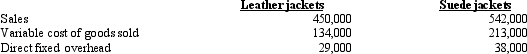

Prepare a segmented income statement for Mario Co.for the coming year,using variable costing.

A sales commission of 2% of sales is paid for each of the two product lines.Direct fixed selling and administrative expense was estimated to be $32,000 for the leather jackets and $66,000 for the suede jackets.Common fixed overhead for the factory was estimated to be $83,000 and common selling and administrative expense was estimated to be $14,000.

A sales commission of 2% of sales is paid for each of the two product lines.Direct fixed selling and administrative expense was estimated to be $32,000 for the leather jackets and $66,000 for the suede jackets.Common fixed overhead for the factory was estimated to be $83,000 and common selling and administrative expense was estimated to be $14,000.

Required: Prepare a segmented income statement for Mario Co.for the coming year,using variable costing.

Correct Answer:

Verified

Q92: The inventory cost that can include insurance,

Q100: Baker Company produced 30,000 units and sold

Q101: Ellie Manufacturing Company produces three products: A,B,and

C.The

Q102: Laird Company uses 405 units of a

Q103: List three problems inventory was meant to

Q105: You decide

You have just become the controller

Q106: Simon Company sells 900 units of its

Q107: Mario Co.produces three products: LMC,DMC,KPC.For the coming

Q109: Simon Company sells 900 units of its

Q122: What is the difference between absorption-costing income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents