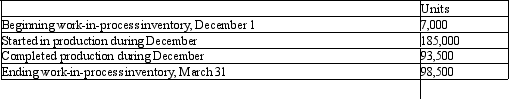

Titan Manufacturing uses a process cost system.The following information pertains to operations for the month of December.

The beginning inventory was 80% complete for materials and 40% complete for conversion costs.The ending inventory was 85% complete for materials and 30% complete for conversion costs.

The beginning inventory was 80% complete for materials and 40% complete for conversion costs.The ending inventory was 85% complete for materials and 30% complete for conversion costs.

Costs pertaining to the month of December are as follows:

Beginning inventory costs are: materials,$38,200; conversion cost $41,400.

Costs incurred during December are: materials used,$462,300; conversion cost $602,700.

Required:

A.Using the weighted average method calculate the total equivalent units of production for direct materials and conversion cost.

B.Using the weighted average method,calculate the unit cost of materials and conversion for December.

C.Using the weighted average method,calculate the total cost of the units in the ending work-in-process inventory at December 31.

Correct Answer:

Verified

Q149: Indigo Inc.,manufactures a product that passes through

Q150: Plemmon Company adds materials at the beginning

Q151: Royal,Inc.,manufactures products that pass through two or

Q152: AL Corporation produces a product that passes

Q154: Garrison Inc.manufactures product where all manufacturing inputs

Q155: You Decide

The controller has asked you do

Q158: King Corporation produces a product that passes

Q161: Describe the differences between process costing and

Q172: Describe the differences in the ways that

Q175: Explain the role of the departmental production

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents