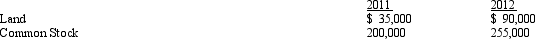

Tracy Company reported the following information at the end of 2011 and 2012:  An analysis of the company's records indicated that there were no cash flow effects resulting from the changes in the two accounts presented above.How should Tracy report the changes in these accounts on a statement of cash flows?

An analysis of the company's records indicated that there were no cash flow effects resulting from the changes in the two accounts presented above.How should Tracy report the changes in these accounts on a statement of cash flows?

A) The company should report $55,000 for the acquisition of land as an investing activity and $55,000 for the issuance of stock as a financing activity.

B) The company should report $55,000 as a noncash investing and financing activity for the acquisition of land by issuing common stock.

C) The company should report the issuance of common stock to acquire land in the financing activity section with a net cash flow effect of zero.

D) The company should report the acquisition of land by issuing common stock in the investing activity section with a net cash flow effect of zero.

Correct Answer:

Verified

Q62: If a company has both an inflow

Q66: Which one of the following items is

Q71: Which of the following would not be

Q75: Starting with net income and adjusting it

Q76: Which one of the following affects cash

Q81: In preparing the statement of cash flows,

Q91: In calculating cash flows from operating activities

Q92: In calculating cash flows from operating activities

Q93: Which of the following financing activities results

Q98: In calculating cash flows from operating activities

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents