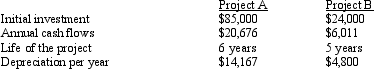

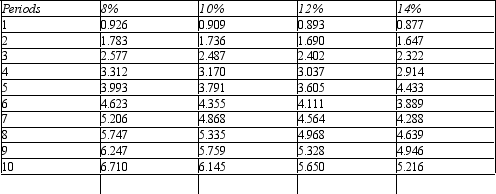

Figure 14-9. Kenner Company is considering two projects. Present value of an Annuity of $1 in Arrears

Present value of an Annuity of $1 in Arrears Refer to Figure 14-9.Suppose that Kenner Company requires a minimum rate of return of 8 percent.Which project is better in terms of net present value?

Refer to Figure 14-9.Suppose that Kenner Company requires a minimum rate of return of 8 percent.Which project is better in terms of net present value?

A) Project A with NPV of $10,585

B) Project B with NPV of $7,756

C) Project A with NPV of $4,210

D) Project B with NPV of $1,212

E) Both projects have the same NPV

Correct Answer:

Verified

Q128: Which of the following compares the actual

Q131: A follow-up analysis of a capital investment

Q131: Five mutually exclusive projects had the following

Q132: A division manager is choosing between two

Q133: How do NPV and IRR differ?

A) NPV

Q136: The best person/group in a firm to

Q137: Which of the following is a disadvantage

Q137: When investing in automated systems,which of the

Q140: The capital investment decision making model that

Q152: A series of equal future cash flows

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents