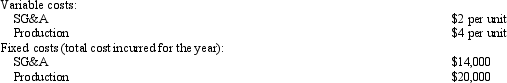

Oakwood Corporation Oakwood Corporation produces a single product.The following cost structure applied to its first year of operations: Refer to Oakwood Corporation.Assume for this question only that during the current year Oakwood Corporation manufactured 5,000 units and sold 3,800.There was no beginning or ending work-in-process inventory.How much larger or smaller would Oakwood Corporation's income be if it uses absorption rather than variable costing?

Refer to Oakwood Corporation.Assume for this question only that during the current year Oakwood Corporation manufactured 5,000 units and sold 3,800.There was no beginning or ending work-in-process inventory.How much larger or smaller would Oakwood Corporation's income be if it uses absorption rather than variable costing?

A) The absorption costing income would be $6,000 larger.

B) The absorption costing income would be $6,000 smaller.

C) The absorption costing income would be $4,800 larger.

D) The absorption costing income would be $4,000 smaller.

Correct Answer:

Verified

Q103: Why should predetermined overhead rates be used?

Q112: What are three reasons that overhead must

Q163: Alpha,Beta,and Gamma Companies Three new companies (Alpha,Beta,and

Q164: At its present level of operations,a small

Q166: Alpha,Beta,and Gamma Companies Three new companies (Alpha,Beta,and

Q168: Sheets Corporation The following information was extracted

Q169: Alpha,Beta,and Gamma Companies Three new companies (Alpha,Beta,and

Q170: Sheets Corporation The following information was extracted

Q172: The following information regarding fixed production costs

Q197: Discuss underapplied and overapplied overhead and its

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents