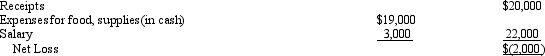

The Evans Company has been operating a small lunch counter for the convenience of employees.The counter occupies space that is not needed for any other business purpose.The lunch counter has been managed by a part-time employee whose annual salary is $3,000.Yearly operations have consistently shown a loss as follows:

A company has offered to sell Evans Company automatic vending machines for a total cost of $12,000.Sales terms are cash on delivery.The old equipment has zero disposal value.

A company has offered to sell Evans Company automatic vending machines for a total cost of $12,000.Sales terms are cash on delivery.The old equipment has zero disposal value.

The predicted useful life of the equipment is 10 years,with zero scrap value.The equipment will easily serve the same volume that the lunch counter handled.A catering company will completely service and supply the machines.Prices and variety of food and drink will be the same as those that prevailed at the lunch counter.The catering company will pay 5 percent of gross receipts to the Evans Company and will bear all costs of food,repairs,and so forth.The part-time employee will be discharged.Thus,Evans Company's only cost will be the initial outlay for the machines.

Consider only the two alternatives mentioned.Present value tables or a financial calculator are required.

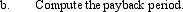

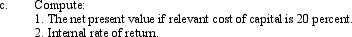

Required:

Correct Answer:

Verified

Q165: In a net present value analysis,how can

Q168: Why is it important for organizations to

Q174: What factors influence the present value of

Q174: Steve Black has just turned 65.He has

Q176: Cornwell Publishers is considering an investment that

Q178: Pacino Productions is considering the purchase of

Q179: Whitmire Corporation

Whitmire Corporation is considering an investment

Q180: Why is it important for managers to

Q182: The Spotless Car Corporation is contemplating the

Q183: The Precise Printing Corporation is contemplating the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents