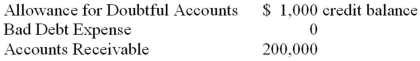

Prior to the year-end adjustment to record bad debt expense for 2014 the general ledger of Stickler Company included the following accounts and balances:  Cash collections on accounts receivable during 2014 amounted to $450,000. Sales revenue during 2014 amounted to $800,000, of which 75% was on credit, and it was estimated that 2% of these credit sales made in 2014 would ultimately become uncollectible.

Cash collections on accounts receivable during 2014 amounted to $450,000. Sales revenue during 2014 amounted to $800,000, of which 75% was on credit, and it was estimated that 2% of these credit sales made in 2014 would ultimately become uncollectible.

Required:

A. Calculate the bad debt expense for 2014.

B. Determine the adjusted 2014 year-end balance of the allowance for doubtful accounts.

C. Determine the net realizable value of accounts receivable for the December 31, 2014 balance sheet.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q107: Hickory Corporation recorded sales revenue during the

Q108: Cyclone Inc. reported the following figures

Q108: Why is the reconciliation of a company's

Q109: During 2014, Charles Inc. recorded credit sales

Q112: Cyclone Inc. reported the following figures

Q112: Which of the following transactions does not

Q114: One of Hawk Company's customers returned products

Q114: A portion of the income statement for

Q116: Matrix Corp. reported the following figures from

Q117: One of Trent Company's customers returned products

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents