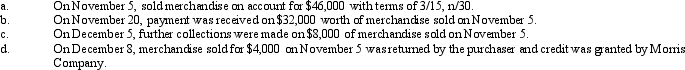

The following are transactions of the Morris Company:

Required:

Required:

Record the appropriate amounts under the gross price, net price, and allowance methods in the spaces below.For each method, write the amount to be debited or credited on the appropriate line for each account shown.Indicate that the amount is a debit or credit by placing a (d)or (c)after the amount.

a. To record sale on Nov. 5:

b. To record payment received on Nov. 20

c. To record payment recenved on Dec. 5:

d. To record sales returin on Dec.8:

Correct Answer:

Verified

Q88: Pollock Supply Co.makes American Express credit card

Q89: Emmet Co.'s records reveal the following

Q90: When a company extends credit to its

Q91: During 2010, Dawson's first year of

Q92: Although IFRS contain the same basic guidelines

Q94: A student in the accounting principles course

Q95: Plaza Bell, Inc.uses the bank reconciliation form

Q96: In certain circumstances a company may find

Q97: Littleton Corporation reports the following information:

Q98: On April 7, Willow, Inc.sold goods for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents