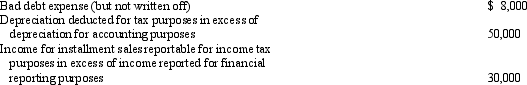

For the year ended December 31, 2010, the Huntsville Company reported income of $350, 000 before provision for income tax.In arriving at taxable income for income tax purposes, the following differences were identified:  Assuming a corporate income tax rate of 30%, Huntsville's current income tax liability as of December 31, 2010, is

Assuming a corporate income tax rate of 30%, Huntsville's current income tax liability as of December 31, 2010, is

A) $ 83, 400

B) $101, 400

C) $113, 400

D) $129, 000

E) none of these

Correct Answer:

Verified

Q30: All of the following involve a temporary

Q31: Temporary differences arise when expenses or

Q32: Langtry Corporation began operations in 2009

Q33: All of the following are conclusions reached

Q34: Duncanville Company appropriately uses the installment

Q36: Interperiod tax allocation is required for all

Q37: The Alamo Heights Company installs sprinkler systems

Q38: Temporary differences arise when revenues or

Q39: The interperiod tax allocation method that is

Q40: In 2010, its first year of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents