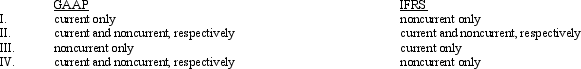

The acceptable balance sheet classifications for deferred tax assets and deferred tax liabilities under GAAP and IFRS are

A) I

B) II

C) III

D) IV

Correct Answer:

Verified

Q57: Boerne Company received rent in advance of

Q58: On January 1, 2010, Bedford Company

Q59: Intraperiod tax allocation would be appropriate for

A)an

Q60: In 2010, its first year of operations,

Q61: For each item listed below, indicate whether

Q63: The recognition of gross profit on installment

Q64: FASB Statement No.109 allows the recognition of

Q65: Which one of the following requires intraperiod

Q66: FASB Statement No.109 discussed deferred tax asset

Q67: On December 31, 2010, the South Padre

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents