During 2010, Sanchez, Inc.had the following convertible securities outstanding:

A. of par, convertible preferred stock. Each share is convertible into 5 shares of common stock.

B. of conventible bonds. Each bond is convertible into 45 shares of conmon stock

C. of convertible boncks. Each bond is convertible into 32 shares of common stock.

D. of par, convertible preferred stock. Each share is convertible into 5 shares of common stock.

Sanchez, Inc.has an income tax rate of 40%.

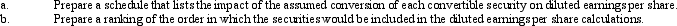

Required:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: On January 1, 2010, Cain Co.had 20,

Q62: On January 1, Roberts reported total stockholders'

Q63: The following information is provided for

Q64: When recording the receipt of donated assets,

Q65: Rhonda Company had 40, 000 shares of

Q67: The two defined sections of stockholders' equity

Q68: Going Green, Inc.had 18, 000 shares of

Q69: Murray Co.had 60, 000 common shares outstanding

Q70: Monster, Inc.determined the following information concerning

Q71: During 2010, Sanchez, Inc.had the following convertible

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents