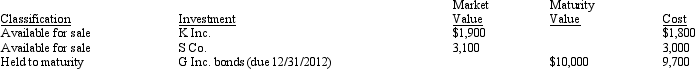

On January 1, 2010, A Corp.had the following investments:

During the year, A Corp.acquired for trading M Co.stock for $1, 000.At year-end, the stock has a fair market value of $1, 200.The K Inc.investment was transferred from AFS to trading on December 31 when the fair market value was $2, 500.The S Co.investment had a December 31 market value of $3, 500.The G Inc.bonds had a fair market value on December 31 of $9, 850.

During the year, A Corp.acquired for trading M Co.stock for $1, 000.At year-end, the stock has a fair market value of $1, 200.The K Inc.investment was transferred from AFS to trading on December 31 when the fair market value was $2, 500.The S Co.investment had a December 31 market value of $3, 500.The G Inc.bonds had a fair market value on December 31 of $9, 850.

Required:

What disclosures are required in the December 31, 2010 financial statements for investments?

Correct Answer:

Verified

Q79: William, Inc.purchased a $400, 000 life insurance

Q80: Exhibit 15-2 On January 1, 2010, the

Q81: Discuss the three categories of investments described

Q82: Current GAAP requires a company to

Q83: A derivative may be

A)an asset account

B)a liability

Q85: On December 31, 2010, the England Company

Q86: ABC Company has been purchasing stock of

Q87: Loans and receivables can be classified

Q88: Reversals of impairment losses on held-to-maturity

Q89: Under current GAAP for marketable securities, trading

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents