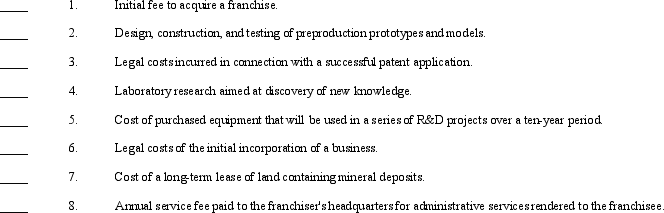

Costs associated with various intangibles of a company may either be expensed when incurred or capitalized and amortized.Such costs might be recorded in any of the following ways:

a. charged to the patent account and amortized

b. charged to the franchise ac count and amortized

c. charged to other appropriate asset ac counts and amortized or depreciateo

d. charged to expense when incurred

Required:

Indicate how each of the following costs should be recorded by placing the appropriate letter (a-d)in the space provided.

Correct Answer:

Verified

Q63: Young Co.received a patent on a new

Q64: FASB has argued that not amortizing certain

Q65: On January 1, 2010, Sable, Inc.bought a

Q66: Certain activities are listed below.

Q67: Impairment losses may be reversed under

Q69: Routine accounting for goodwill under IFRS versus

Q70: The Arnao Corporation is contemplating building a

Q71: The determination of impairment losses differs under

Q72: Consider the following information from a company's

Q73: An argument in favor of capitalizing purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents