The Jessie Company acquired a competitor company in January 2010.When Jessie's accountant recorded the purchase, she correctly recorded an amount for goodwill based on the expectation of the acquired company's earning a rate of return on its assets that was in excess of the industry's rate of return.In fact, the acquired company doubled the expected rate of return in 2010 and 2011.As a result of these increased earnings, in early 2012 the president of the Jessie Company asked the company's accountant to increase the amount recognized as goodwill.

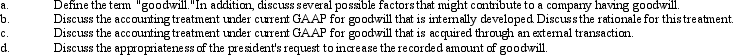

Required:

Correct Answer:

Verified

Q57: Which of the following statements regarding intangible

Q58: Which of the following is not a

Q59: The Cougar Company was formed in early

Q60: The Apple Company agreed to purchase the

Q61: Consider the following information from a company's

Q63: Young Co.received a patent on a new

Q64: FASB has argued that not amortizing certain

Q65: On January 1, 2010, Sable, Inc.bought a

Q66: Certain activities are listed below.

Q67: Impairment losses may be reversed under

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents