Starbellies Tattoo Parlor LLC is completing the accounting process for its year ended 12/31/14.The transactions for the year have been journalized and posted.Information for adjusting entries appears below.

a.The supplies account shows a balance of $900.A count of supplies revealed $400 on hand at 12/31/14.

b.A one-year insurance policy was purchased for $1,200 on 12/1/14.It was recorded as Prepaid Insurance at that time.

c.Office equipment depreciates at a rate of $1,000 per year.The equipment has been owned all year.

d.A client paid $10,000 in advance for services to be rendered later,which was recorded as unearned revenue.Of this amount,30% was earned as of 12/31/14.

e.Employees earn $5,000 for a 5-day work week.December 31,2014 falls on a Tuesday.

f.Starbellies has completed $500 of work for which it has neither received cash nor billed the client.

A)For each of the adjusting items (a-f)prepare the adjusting journal entry that would be required at 12/31/14.

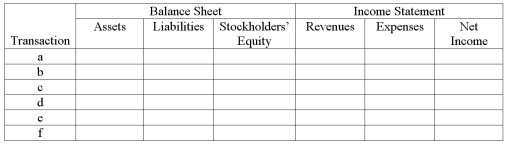

B)For each of the adjusting items (a-f)indicate the amount and the direction of effects of the adjusting journal entry on the elements of the balance sheet and income statement.

Using the following format,indicate + for increase,- for decrease,and NE for no effect.

Correct Answer:

Verified

Q29: Accrued revenues recorded at the end of

Q136: A company billed a client for services

Q138: When are adjusting entries made?

A)At the beginning

Q139: Which of the following is not a

Q142: Insert the appropriate letter A,D,or C into

Q143: Required:

A)Calculate the income before income tax.

B)Calculate the

Q144: Prepare an income statement and a statement

Q145: Below is an alphabetical listing of all

Q146: For each of the following transactions,match the

Q206: Which of the following is the usual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents