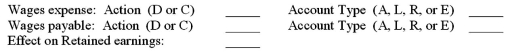

For each of the following transactions,match the action (Debit or Credit)and the account type (Asset,Liability,Revenue,or Expense)to each account for the appropriate adjustment that needs to be made at the end of June.Also,show the effect on Retained Earnings.

(D)Debit or (C)Credit

(A)Asset, (L)Liability, (R)Revenue or (E)Expense Account  or

or  Retained Earnings

Retained Earnings

a.The company has insurance costs of $620 a day for the month of June.On June 1 the company had $26,000 of prepaid insurance.  b.The company provides services in June for which it had received payment of $18,300 in May.

b.The company provides services in June for which it had received payment of $18,300 in May.  c.The company had $12,500 worth of labor performed by workers who will be paid in July.

c.The company had $12,500 worth of labor performed by workers who will be paid in July.  d.The company had income before income taxes of $287,400 for June and will pay taxes at the rate of 36%.The tax will be paid in July.

d.The company had income before income taxes of $287,400 for June and will pay taxes at the rate of 36%.The tax will be paid in July.  e.The company had interest of $1,000 due for June on a Certificate of Deposit (CD).The interest will be received in August.

e.The company had interest of $1,000 due for June on a Certificate of Deposit (CD).The interest will be received in August.

Correct Answer:

Verified

Q29: Accrued revenues recorded at the end of

Q138: When are adjusting entries made?

A)At the beginning

Q139: Which of the following is not a

Q141: Starbellies Tattoo Parlor LLC is completing the

Q142: Insert the appropriate letter A,D,or C into

Q143: Required:

A)Calculate the income before income tax.

B)Calculate the

Q144: Prepare an income statement and a statement

Q145: Below is an alphabetical listing of all

Q147: On December 31,2014,Purrfect Pets had retained earnings

Q206: Which of the following is the usual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents