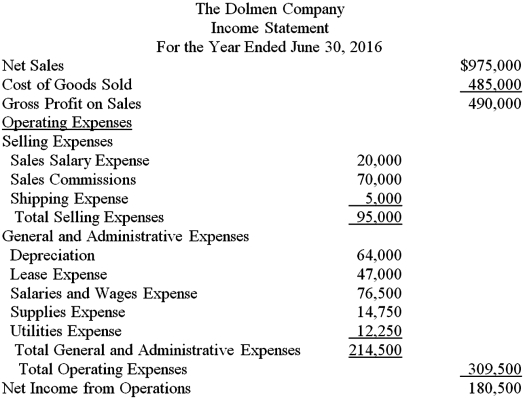

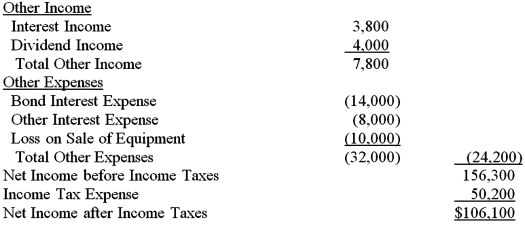

Additional Information: Equipment Costing $100,000 Was Sold for $70,000.Accumulated Depreciation on This

Additional information:

Additional information:

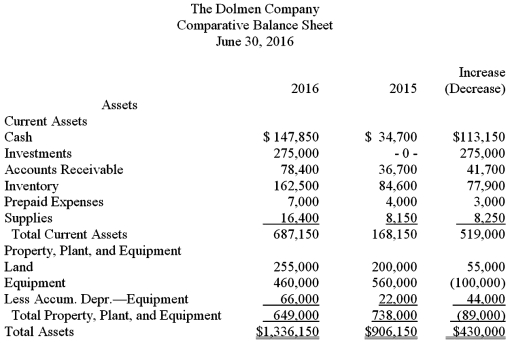

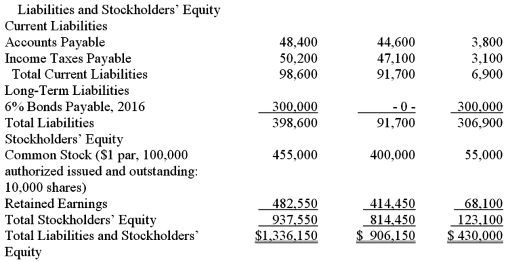

Equipment costing $100,000 was sold for $70,000.Accumulated depreciation on this equipment was $20,000.

Dividends of $38,000 were declared and paid.

Bonds were issued at face value of $300,000.

Common stock of $55,000 was issued to acquire land.

Investments (stock in IBM)were purchased for $275,000.

Using the information provided,prepare the cash flows from financing activities for The Dolmen Company.

Correct Answer:

Verified

Q97: Eleemosynary Organization acquired land valued at $56,000

Q98: For each of the following operating activities,indicate

Q100: A list of sources and uses of

Q100: Corporations do not commonly use the direct

Q102: Based only on the information provided,prepare the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents