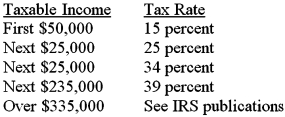

After all revenue and expense accounts,other than Income Tax Expense,have been extended to the Income Statement section of the worksheet of Tyler Corporation,the net income is determined to be $50,000.Using the following corporate income tax rates,compute the corporation's federal income taxes payable.(Assume that the firm's taxable income is the same as its income for financial accounting purposes. )

Correct Answer:

Verified

Q89: After all revenue and expense accounts,other than

Q90: A corporation has paid estimated income taxes

Q91: A corporation has paid estimated income taxes

Q92: A corporation has paid estimated income taxes

Q93: A corporation has paid estimated income taxes

Q94: After all revenue and expense accounts,other than

Q95: A corporation has paid estimated income taxes

Q96: On August 10,2016 a corporation received a

Q97: A corporation reported a net income of

Q98: After all revenue and expense accounts,other than

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents