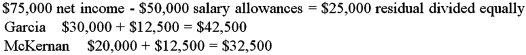

Partnership net income of $75,000 is to be divided between two partners,Bob Garcia and Jerry McKernan,according to the following arrangement: There will be salary allowances of $30,000 for Garcia and $20,000 for McKernan,with the remainder divided equally.How much of the net income will be distributed to Garcia and McKernan,respectively?

A) $40,000 and $30,000

B) $42,500 and $32,500

C) $45,000 and $35,000

D) $67,500 and $57,500

Correct Answer:

Verified

Q62: Kara Johnson and Tyler Jones are partners,

Q70: The entry to record a partner's salary

Q71: The entry to record the equal distribution

Q72: Which of the following statements is correct?

A)

Q73: Ben White and Lisa Caputi are partners,and

Q74: The partners' salary and interest allowances are

Q76: All of the following are included on

Q77: The salary and interest allowances in a

Q79: If no other method of dividing net

Q80: Partnership net income of $33,000 is to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents