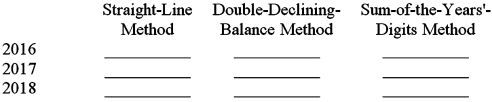

On January 2,2016,the Hanover Company purchased some office equipment for $20,000.The equipment is expected to have a useful life of five years and a salvage value of $2,000.Prepare a schedule showing the annual depreciation for each of the first three years of the asset's life under the straight-line method,the double-declining-balance method,and the sum-of-the-years'-digits method.

Correct Answer:

Verified

Q85: Modern Products Company purchased new packaging equipment

Q85: For federal income tax purposes, the depletion

Q86: Dom's Delivery purchased a van for $32,000.The

Q87: Blue Box Company was purchased for $115

Q87: When computing depreciation,the salvage value should be

Q88: In 2016 Lucky Mining Company paid $800,000

Q92: Which of the following is NOT a

Q93: Intangible assets may be purchased or developed.If

Q94: On January 3,2016,the Soloman Toy Company purchased

Q95: Under MACRS,the highest percent-resulting in the highest

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents