Jackson Autos has one employee.As of March 30,their employee had already earned $6,300.For the pay period ending April 15,their employee earned an additional $4,000 of gross wages.Only the first $7,000 of annual earnings are subject to FUTA of .6% and SUTA of 5.4%.The journal entry to record the employer's unemployment payroll taxes for the period ending April 15,would be:

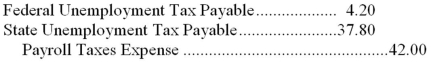

A)

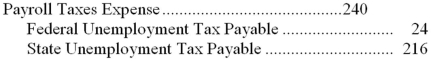

B)

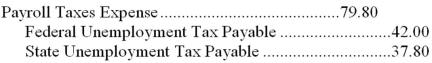

C)

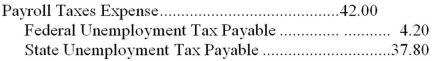

D)

Correct Answer:

Verified

Q34: To record a deposit of federal income

Q35: Only the employer is responsible for paying

A)

Q36: Which of the following taxes is not

Q37: During the week ended June 15,Wiley Automotive's

Q38: The frequency of deposits of federal income

Q40: Each employee of a firm will receive

Q41: ABC Consulting had two employees with the

Q42: Rick O'Shea,the only employee of Hunter Furniture

Q43: This preprinted government form is used to

Q44: To record the payment of SUTA tax,the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents