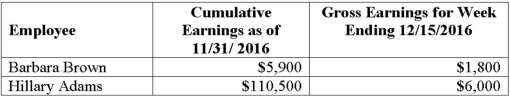

George's Gameroom had two employees with the following earnings information:  Use the table above and calculate how much of Hillary's December 15 paycheck is still subject to Social Security tax given that the tax is levied on the first $113,700 of annual wages and the Medicare tax rate is 1.45% on all earnings.

Use the table above and calculate how much of Hillary's December 15 paycheck is still subject to Social Security tax given that the tax is levied on the first $113,700 of annual wages and the Medicare tax rate is 1.45% on all earnings.

A) $2,500

B) $2,800

C) $3,200

D) $6,000

Correct Answer:

Verified

Q34: Tax returns for the federal unemployment tax

Q41: ABC Consulting had two employees with the

Q42: Rick O'Shea,the only employee of Hunter Furniture

Q43: This preprinted government form is used to

Q44: To record the payment of SUTA tax,the

Q47: Kristy Casey earns $39,000 per year and

Q48: Generally,the base earnings subject to state unemployment

Q49: Most states require that the employer file

Q50: Jerry Little's gross wages as of October

Q51: Roy DeSoto earns a regular hourly salary

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents