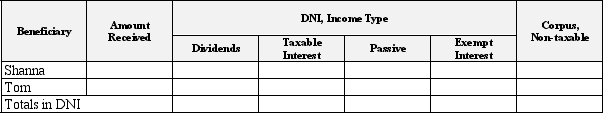

The Willa estate reports $100,000 DNI, composed of $50,000 dividends, $20,000 taxable interest, $10,000 passive income, and $20,000 taxexempt interest. Willa's two noncharitable income beneficiaries, Shanna and Tom, receive distributions of $75,000 each. How much of each class of income is deemed to have been distributed to Shanna? To Tom? Use the following template to structure your answer.

Correct Answer:

Verified

Q126: Counsell is a simple trust that correctly

Q128: Counsell is a simple trust that correctly

Q129: The Gomez Trust is required to distribute

Q130: The Yan Estate is your client,as are

Q132: The Moot Trust distributes an asset to

Q132: The Federal income taxation of a trust

Q133: Consider the term distributable net income as

Q135: List at least three non-tax reasons that

Q137: Your client Pryce is one of the

Q151: Identify the parties that are present when

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents