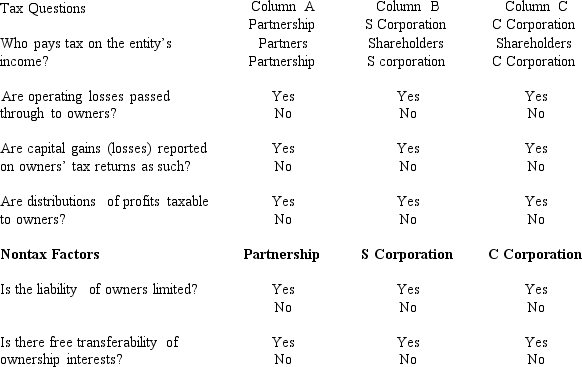

Compare the basic tax and nontax factors of doing business as a partnership, an S corporation, and a C corporation. Circle the correct answers.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: What is a limited liability company? What

Q64: Dawn is the sole shareholder of Thrush

Q88: A taxpayer is considering the formation of

Q89: In each of the following independent

Q90: During the current year, Gray Corporation, a

Q92: Ostrich, a C corporation, has a

Q94: Heron Corporation, a calendar year, accrual

Q95: During the current year, Coyote Corporation

Q125: Explain the rules regarding the accounting periods

Q127: Contrast the tax treatment of capital gains

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents