Paul & Stephan: on January 1, 20X1, Paul, Inc On January 2, 20X3, Stephan Sold 2,000 Additional Shares in a 90

Paul & Stephan: On January 1, 20X1, Paul, Inc. acquired a 90% interest in Stephan Company. The $45,000 excess of purchase price (parent's share only) was attributable to goodwill. On January 1, 20X3, Stephan Company had the following stockholders' equity:

On January 2, 20X3, Stephan sold 2,000 additional shares in a private offering.

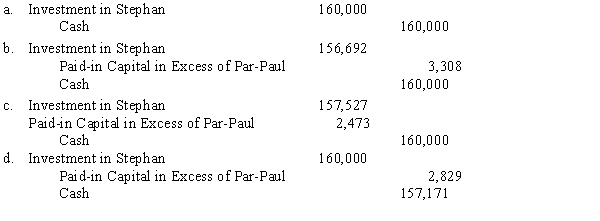

-Refer to Paul and Stephan. Stephan issued the new shares for $80 per share; Paul, Inc. purchased all the shares. What is the journal entry that Paul will prepare to record this investment?

Correct Answer:

Verified

1 (9,000 + 2,000) ÷ (10,000 + ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: When the parent purchases some newly issued

Q6: Paris & Scott: On January 1,

Q7: When a parent purchases a portion of

Q8: When a parent purchases a portion of

Q11: Paris & Scott: On January 1,

Q12: Company P purchased a 80% interest

Q13: Able Company owns an 80% interest in

Q14: Which of the following situations is a

Q15: Able Company owns an 80% interest in

Q19: Apple Inc. owns a 90% interest in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents