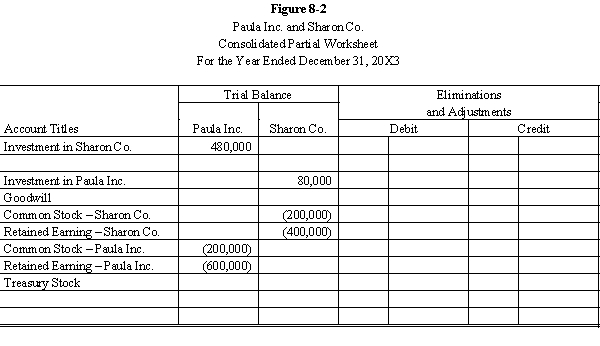

Paula Inc. purchased an 80% interest in the Sharon Co. for $480,000 on January 1, 20X1, when Sharon Co. had the following stockholders' equity:

Any excess is attributable to goodwill.

On January 1, 20X3, Sharon Co. purchased a 10% interest in the Paula Inc. at a price equal to book value. Both firms maintain investments under the cost method.

Required:

a.

Complete the Figure 8-2 partial worksheet for December 31, 20X3, assuming the use of the treasury stock method.

b.

Calculate the distribution of income for 20X3, assuming that internally generated net income is $50,000 for Paula and $20,000 for Sharon.

Correct Answer:

Verified

For the worksheet...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: Manke Company owns a 90% interest in

Q24: On January 1, 20X1, Parent Company purchased

Q25: On January 1, 20X1, Prism Company

Q27: Parrot, Inc. purchased a 60% interest in

Q28: On January 1, 20X1, Parent Company

Q30: On January 1, 20X1, Parent Company purchased

Q31: On January 1, 20X1, Parent Company purchased

Q32: Plum & Sterling: Plum Inc. acquired 90%

Q33: Plum & Sterling: Plum Inc. acquired 90%

Q34: On January 1, 20X1, Prism Company purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents