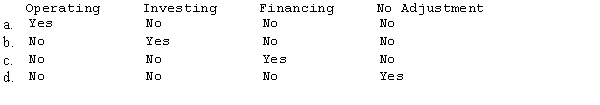

Company P purchased an 80% interest in Company S on January 1, 20X3, at a price in excess of book value, such that a patent arises in the consolidation process. As a result of amortizing the patent on the consolidated income statement, an adjustment would be required in which section of the consolidated statement of cash flows?

Correct Answer:

Verified

Q4: For two or more corporations to file

Q6: In calculating the voting power and market

Q7: Which of the following statements is true

Q8: Consolidated Basic Earnings Per Share (BEPS) is

Q11: Dividends paid by a subsidiary have the

Q12: Company P acquired 80% of the outstanding

Q13: When the acquisition of a subsidiary occurs

Q15: Ponti Company purchased the net assets

Q16: The cash purchase of 80% interest in

Q17: The purchase of additional shares directly from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents