On January 1, 20X8, Paul Company purchased 80% of the common stock of Smith Company for $300,000. On this date Smith had total owners' equity of $350,000. Any excess of cost over book value is attributed to a patent, to be amortized over 10 years.

During 20X8, Paul has accounted for its investment in Smith using the simple equity method.

During 20X8, Paul sold merchandise to Smith for $50,000, of which $10,000 is held by Smith on December 31, 20X8. Paul's gross profit on sales is 40%.

During 20X8, Smith sold some land to Paul at a gain of $10,000. Paul still holds the land at year end.

Paul and Smith qualify as an affiliated group for tax purposes and thus will file a consolidated tax return. Assume a 30% corporate income tax rate.

Required:

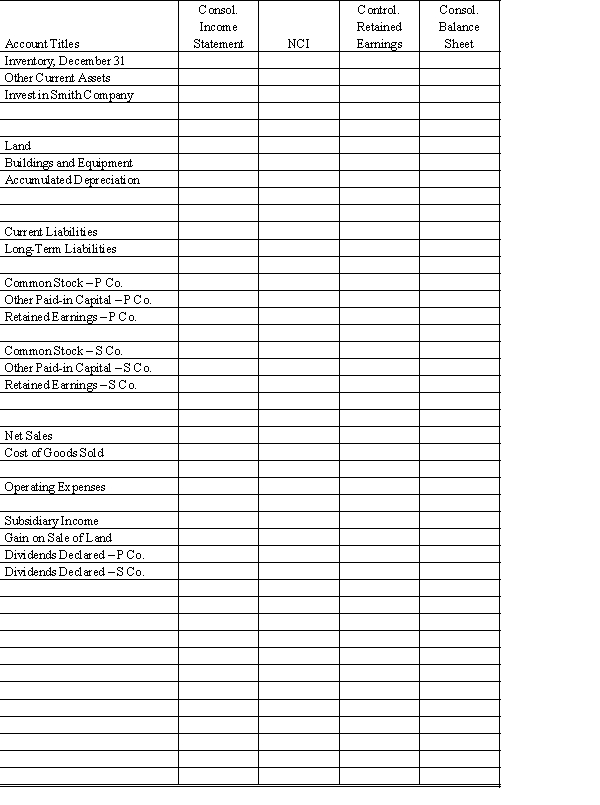

Complete the Figure 6-3 worksheet for consolidated financial statements for the year ended December 31, 20X8.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Company P acquired 75% of the outstanding

Q21: Dills & Sarada scenario:

Dills Company purchased an

Q21: For ownership interest of at least 20%

Q22: Consolidated Return Scenario: Company P purchased an

Q23: Consolidated Return Scenario: Company P purchased an

Q26: Consolidated Return Scenario: Company P purchased an

Q27: Consolidated Return Scenario: Company P purchased an

Q27: When an affiliated group elects to be

Q30: Dills & Sarada scenario:

Dills Company purchased an

Q40: For ownership interest of less than 20%,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents