Plymouth Company Holds a 90% Interest in Savannah, Inc The Warrants to Acquire Savannah Stock Were Issued July 1

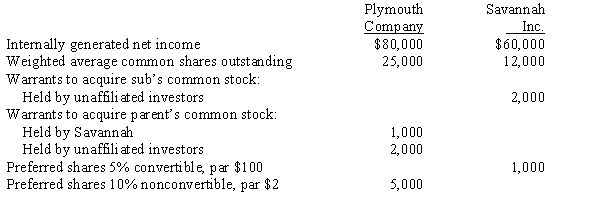

Plymouth Company holds a 90% interest in Savannah, Inc., which was acquired in a previous year. As of the end of the current fiscal period, the following information is available:

Additional information:

Additional information:

The warrants to acquire Savannah stock were issued July 1 of the current year. Exercise price is $9; stock price is $12.

The warrants to acquire Plymouth stock were issued in a previous fiscal period. Exercise price is $12; stock price is $18.

Each share of convertible preferred can be converted into 5 shares of Savannah common stock. Plymouth owns 60% of the convertible preferred stock.

Required:

Compute consolidated basic and diluted earnings per share for the current year. Ignore any tax effects.

Correct Answer:

Verified

Q30: Consolidated firms that meet the tax law

Q34: Company S has been an 80%-owned subsidiary

Q35: Consolidated Return Scenario: Company P purchased an

Q37: Consolidated Return Scenario: Company P purchased an

Q38: Which of the following statements is true?

A)

Q39: On January 1, 20X1, Parent Company acquired

Q40: The following comparative consolidated trial balances apply

Q41: Plymouth Company holds a 90% interest in

Q42: The following comparative consolidated trial balances apply

Q43: Plateau Company acquires an 80% interest in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents