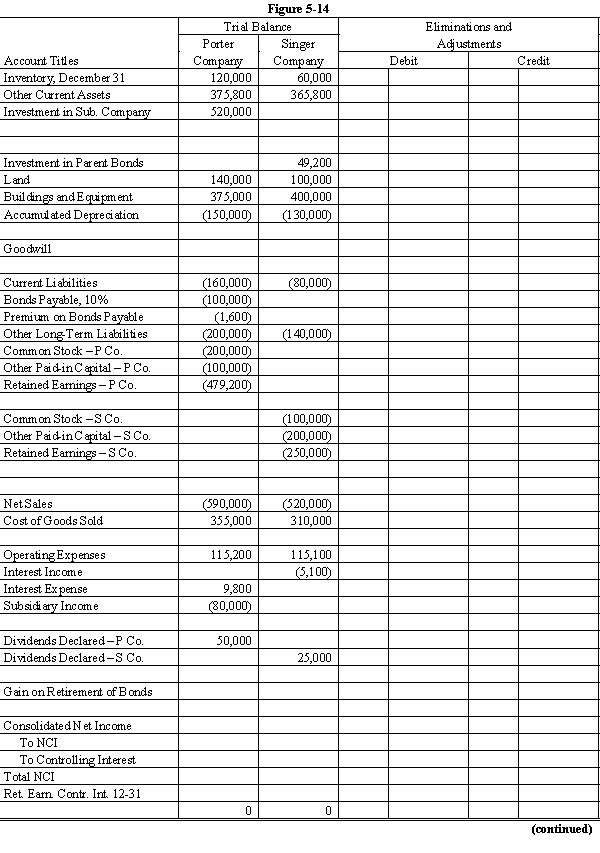

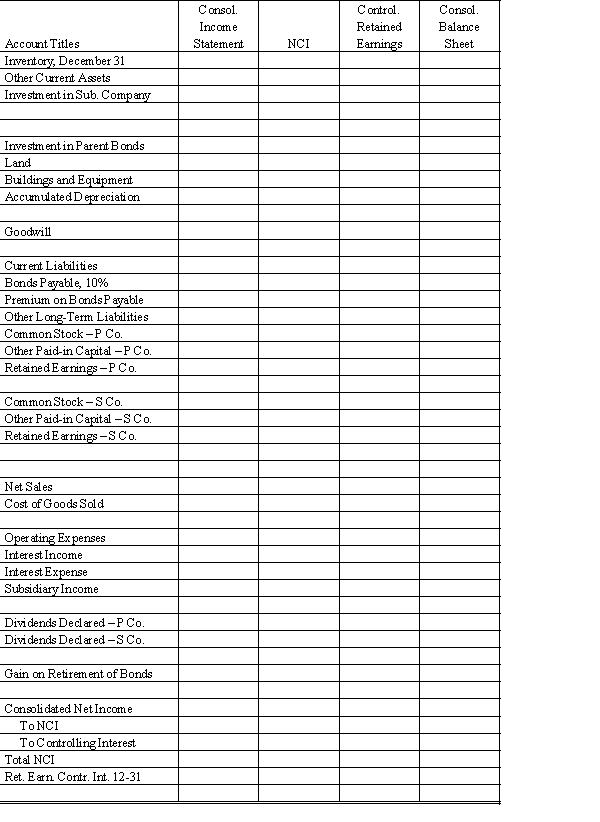

On January 1, 20X1, Porter Company purchased 80% of the common stock of Singer Company for $372,000. On this date Singer had total owners' equity of $440,000. Any excess of cost over book value is due to goodwill. Porter accounts for its investment in Singer using the simple equity method.

On January 1, 20X3, Porter held merchandise acquired from Singer for $40,000. During 20X3, Singer sold merchandise to Porter for $120,000, of which $10,000 is held by Porter on December 31, 20X3. Singer's usual gross profit on affiliated sales is 40%.

On December 31, 20X3, Porter still owes Singer $5,000 for merchandise acquired in December.

On December 31, 20X1, Porter sold $100,000 par value of 10%, 10-year bonds for $102,000. Porter uses the straight-line method of amortization for the premium. The bonds pay interest semi-annually on June 30 and December 31.

On December 31, 20X2, Singer repurchased $50,000 par value of the bonds, paying $49,100. Singer uses the straight-line method of amortization for the discount. The bonds are still held on December 31, 20X3.

Required:

Complete the Figure 5-14 worksheet for consolidated financial statements for the year ended December 31, 20X3. Round all computations to the nearest dollar.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q43: The Planes Company owns 100% of the

Q44: On January 1, 20X1 Parent Company acquired

Q45: On January 1, 20X1, Porter Company purchased

Q46: On January 1, 20X8, Parent Company purchased

Q48: On January 1, 20X1, Parent Company purchased

Q49: On January 1, 20X1, Parent Company purchased

Q50: On January 1, 20X8, Parent Company purchased

Q51: On January 1, 20X8, Pope Company acquired

Q53: On January 1, 20X1, Parent Company acquired

Q54: The Park Company owns 80% of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents