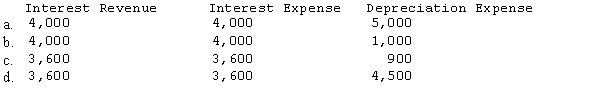

Porch Company owns a 90% interest in the Screen Company. Porch sold Screen a milling machine on January 1, 20X1, for $50,000 when the book value of the machine on Porch's books was $40,000. Porch financed the sale with Screen signing a 3-year, 8% interest, note for the entire $50,000. The machine will be used for 10 years and depreciated using the straight-line method. The following amounts related to this transaction were located on the companies trial balances: Interest Revenue

$4,000

Interest Expense

$4,000

Depreciation Expense

$5,000

Based upon the information related to this transaction what will be the amounts eliminated in preparing the 20X1 consolidated financial statements?

Correct Answer:

Verified

Q2: Phelps Co. uses the sophisticated equity method

Q5: Company P owns 100% of the common

Q5: Diller owns 80% of Lake Company common

Q6: The material sale of inventory items by

Q9: Perry, Inc. owns a 90% interest in

Q9: On January 1, 20X1, a parent loaned

Q12: Scenario 4-1

Stroud Corporation is an 80%-owned subsidiary

Q13: Cattle Company sold inventory with a cost

Q18: Sally Corporation, an 80%-owned subsidiary of Reynolds

Q19: Schiff Company owns 100% of the outstanding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents