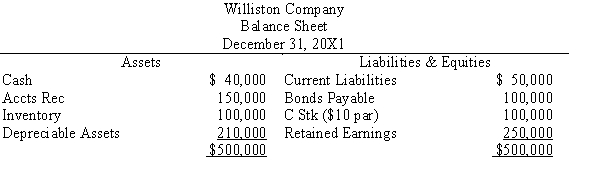

Dickinson Corporation is considering the acquisition of Williston Company through the acquisition of Williston's common stock. Dickinson Corporation will issue 15,000 shares of its $5 par common stock, with a fair value of $30 per share, in exchange for all 10,000 outstanding shares of Williston Company's voting common stock. The acquisition meets the criteria for a tax-free exchange as to the seller. Because of this, Dickinson Corporation will be limited for future tax returns to the book value of the depreciable assets. Dickinson Corporation falls into the 30% tax bracket. The appraisal of the assets of Williston Company shows that the inventory has a fair value of $120,000, and the depreciable fixed assets have a fair value of $250,000 and a 10-year life. Any remaining excess is attributed to goodwill. Williston Company has the following balance sheet just before the acquisition:

Required:

Required:

a.

Prepare a value analysis and a determination and distribution of excess schedule.

b.

Prepare the elimination entries that would be made on the consolidated worksheet on the date of acquisition.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: If the investment in subsidiary account is

Q18: Scenario 3-2

On January 1, 20X1, Promo, Inc.

Q19: In consolidated financial statements, it is expected

Q20: Which of the following statements applying to

Q21: PROBLEM

Scenario 3-4

On January 1, 20X1, Parent Company

Q23: PROBLEM

Scenario 3-4

On January 1, 20X1, Parent Company

Q24: PROBLEM

Scenario 3-4

On January 1, 20X1, Parent Company

Q25: PROBLEM

Scenario 3-4

On January 1, 20X1, Parent Company

Q26: The Paris Company purchased an 80%

Q27: PROBLEM

Scenario 3-4

On January 1, 20X1, Parent Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents