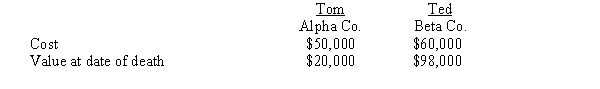

Mr. Riekoff died and left the following stocks to his two sons:

Required:

Required:

a.

If both sons sold their stocks ten months after their father's death for $50,000 and the alternate valuation was not used, what would their respective capital gains/losses be?

b.

Assuming that the price of the stock remained constant in the year prior to Mr. Riekoff's death, what might have been a better method of handling the stocks from a tax planning perspective? Explain why.

Correct Answer:

Verified

Tom's gain = $50,000 - 20,000 = $30,0...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: The double trial balance for estate and

Q25: The primary purpose of an estate's charge

Q25: For estate planning purposes, Albert began distributing

Q26: Which of the following items is not

Q27: The effect of the marital deduction is:

A)total

Q28: Which of the following best describes the

Q30: The gross estate of a decedent:

A)is the

Q31: Which of the following is not a

Q33: A trust created through a will is

Q36: The alternate valuation date is how many

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents