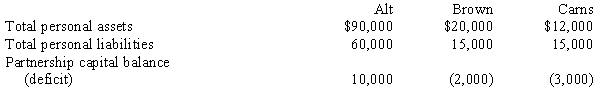

The partnership of Alt, Brown, and Carns has total assets and liabilities of $30,000 and $25,000, respectively. Information relating to the partners is as follows:

Required:

Required:

a.

Assuming that the Uniform Partnership Act is applicable, indicate how the partners' personal assets would be distributed.

b.

Assuming that federal bankruptcy laws are applicable, indicate how the partners' personal assets would be distributed.

c.

Assume that the partnership had a deficit of $10,000, allocated among Alt, Brown, and Carns as follows: $2,000 surplus, $7,000 deficit, and $5,000 deficit, respectively. Indicate how the deficit would be satisfied when bankruptcy laws are applicable.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q37: Oak, Pine, and Maple are partners with

Q38: Martel, Tusk, and Davis are partners

Q39: Partner T is personally insolvent, owing $400,000.

Q40: Scenario 14-2

Assume that a partnership had assets

Q42: Merz, Dechter, and Flowers are partners in

Q43: The Tyler, Russell, and Colby partnership is

Q43: Rogers, Davis, and Smukalla have capital balances

Q45: The ALPHA, BETA, AND DELTA partnership has

Q46: On July 1, 20X9, the Crawford

Q56: Partners Dalton, Edwards, and Finley have capital

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents