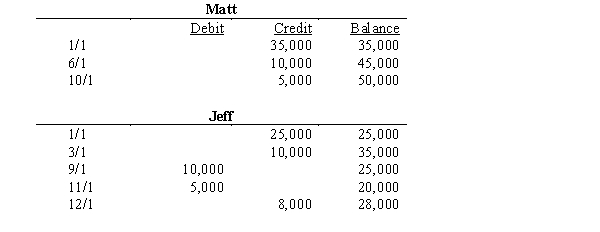

Matt and Jeff organized their partnership on 1/1/00. The following entries were made into their capital accounts during 00:

If partnership profits for the year equaled $66,000, indicate the allocations between the partners under the following independent profit-sharing allocation conditions:

If partnership profits for the year equaled $66,000, indicate the allocations between the partners under the following independent profit-sharing allocation conditions:

a.

Interest of 10% is allocated on weighted average capital balance and the remainder is divided equally

b.

A salary of $9,000 will be allocated to Jeff; 10% interest on ending capital is allocated to the partners; remainder is divided 60/40 to Matt and Jeff, respectively

c.

Salaries are allocated to Matt and Jeff in the amount of $10,000 and $15,000, respectively and the remainder is allocated in proportion to weighted average capital balances

d.

A bonus of 10% of partnership profits after bonus is credited to Matt, a salary of $35,000 is allocated to Jeff, a $20,000 salary is allocated to Matt, 10% interest on weighted capital is allocated, and remainder is split equally

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Under the entity theory, a partnership is

A)viewed

Q22: Barnes and Noble, both lawyers, have decided

Q23: Tupper and Tolin have decided to

Q24: Olsen and Katch organized the OK Partnership

Q25: The Amato, Bergin, Chelsey partnership profit

Q26: Carey and Drew formed a partnership on

Q27: Which of the following characteristics of a

Q30: For financial accounting purposes, assets of an

Q31: Van and Shapiro formed a partnership.

Q44: Cable and Jones are considering forming a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents