Millstone Company's First-Quarter 20X3, Pretax Income Is $25,000 Required:

Calculate the First and Second Quarter Interim Tax Expenses

Millstone Company's first-quarter 20X3, pretax income is $25,000. The company anticipates an annual tax credit of $5,500. Millstone is projecting income for the remaining three quarters of $95,000. For the second quarter of 20X4, Millstone reports $55,000 of pretax income with a projected pre-tax income for the remainder of the year of $65,000. Millstone does not have any permanent differences between taxable income and financial income.

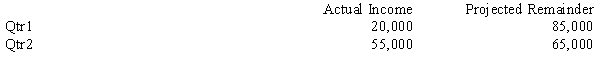

In the second quarter, Millstone decided to change their depreciation method used for financial reporting purposes. The change in depreciation methods has the following effect on the calculation and projection of income for Millstone:

The effect of the change on prior years is a decrease to retained earnings of $30,000.

The effect of the change on prior years is a decrease to retained earnings of $30,000.

The current tax schedule is:

Required:

Calculate the first and second quarter interim tax expenses on continuing income.

Correct Answer:

Verified

Q21: Futura Corporation reported pretax net income of

Q22: Scott Inc. expects to have financial income

Q22: The management approach to segmental reporting

A)focuses on

Q23: Which of the following statements about required

Q24: For each of the following independent cases,

Q28: A corporation made up of an automobile

Q30: With regard to major customers, which of

Q31: Cracker Corporation's first-quarter 20X4, pretax income is

Q33: It is possible for segments to qualify

Q46: Corriveau Industries decided to switch from an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents