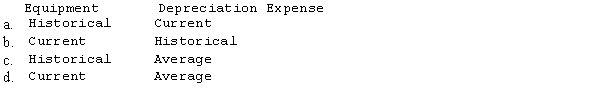

A U.S. parent purchased a foreign subsidiary last year at a price in excess of the subsidiary's book value. This excess is assumed to be traceable to undervalued equipment. When the parent company prepares its elimination entries for the excess, which of the following combinations of exchange rates should be used?

Correct Answer:

Verified

Q1: The functional currency approach adopted by FASB

Q10: Which of the following best describes the

Q11: The eliminations and adjustment entries necessary to

Q11: Exchange rates will not usually directly affect

Q12: When the functional currency is the foreign

Q13: Assuming that a foreign entity is deemed

Q15: In most cases, which of the following

Q17: A U.S. firm owns 100% of a

Q21: The reconciliation of the annual translation adjustment

Q27: Which of the following foreign currency transactions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents