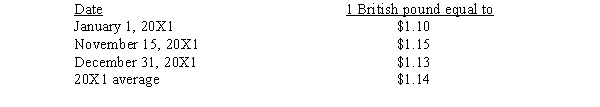

Green Corporation, a wholly owned British subsidiary of a U.S. firm began the year with 1,300,000 British pounds in net assets. The subsidiary incurred a 65,000 British pound net loss for 20X1. The subsidiary issued common stock for 100,000 British pounds on November 15, 20X1. Assume the following exchange rates for 20X1:

Required:

Required:

Compute the translation adjustment for 20X1 using the direct method.

Correct Answer:

Verified

Q52: A French subsidiary of a U.S. firm

Q55: A Kuwaiti subsidiary of Hiawatha Corp. (a

Q56: A foreign subsidiary operates in a highly

Q58: Complete the following worksheet, assuming that on

Q60: An American firm owns 100% of a

Q61: Renta USA, Inc. formed a foreign subsidiary

Q62: On January 1, 20X2, U.S.A. Inc. created

Q67: Company A, an American company, owns Company

Q76: List the two primary objectives of translating

Q77: Foreign firms operating in highly inflationary economies

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents