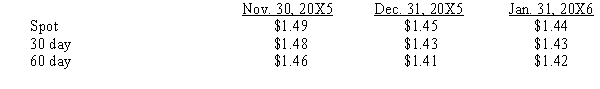

Wild, Inc. sold merchandise for 500,000 FC to a foreign vendor on November 30, 20X5. Payment in foreign currency is due January 31, 20X6. Exchange rates to purchase 1 foreign currency unit are as follows:  In the year in which the sale was made, 20X5, what amount should Wild report as foreign exchange gain/loss from this transaction?

In the year in which the sale was made, 20X5, what amount should Wild report as foreign exchange gain/loss from this transaction?

A) $25,000

B) $20,000

C) $5,000

D) $0

Correct Answer:

Verified

Q17: A bank dealing in foreign currency tells

Q18: A U.S. company purchases medical lab equipment

Q19: Scenario 10-1

On 6/1/X2, an American firm purchased

Q21: The two distinguishing characteristics of a financial

Q22: On November 1, 20X1, DEMO Corp., a

Q24: On September 15, 20X2, Wall Company, a

Q25: Which of the following statements is true

Q26: Pile, Inc. purchased merchandise for 500,000 FC

Q27: Larson, Inc. sold merchandise for 600,000 FC

Q45: In a hedge of a forecasted transaction,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents