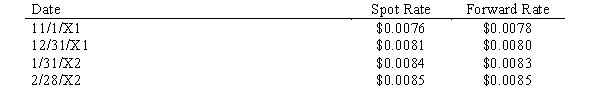

Rex Corporation, a U.S. firm with a calendar accounting year, agreed to buy a specially made truck from a Japanese firm for delivery on January 31, 20X2 with payment due on 2/28/X2. On the same date the agreement was signed, November 1, 20X1, a forward contract due on February 28, 20X2, was also signed to purchase 1,000,000 yen, the contract price of the truck. Exchange rates were as follows:

Discount rate = 8%

Discount rate = 8%

Required:

Prepare the journal entries needed to properly reflect the purchase and forward contract through the end of the fiscal year.

Correct Answer:

Verified

Q20: A United States based company that has

Q37: In the accounting for forward exchange contracts,

Q38: Which of the following is not true

Q43: On January 1, 20X4, Branson Company, a

Q44: On January 1, 20X1, a U.S. firm

Q45: On January 1, 20X1, a domestic firm

Q46: Wolters Corporation is a U.S. corporation

Q47: Bulldog Enterprise, a U.S. firm, agreed on

Q55: The accounting treatment given a cash flow

Q68: Differentiate between the following monetary systems: floating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents