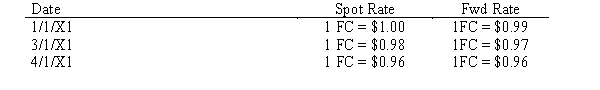

On January 1, 20X1, a domestic firm agrees to sell goods to a foreign customer, with delivery to be made on March 1, 20X1. The goods, valued at 50,000 FCs, are to be paid for 30 days after delivery. On January 1, 20X1, the domestic firm purchased a 90-day forward contract to sell 50,000 FCs. Exchange rates on selected dates are as follows:

Discount rate = 10%

Required:

Required:

Prepare the journal entries needed to properly reflect the sales transaction and the forward exchange contract. The forward contract meets the conditions necessary to be classified as a hedge on an identifiable foreign currency commitment. Include the table to calculate the split between exchange gains or losses on the contract due to changes in spot rates and the changes in time value.

Correct Answer:

Verified

Q42: Rex Corporation, a U.S. firm with a

Q43: On January 1, 20X4, Branson Company, a

Q44: On January 1, 20X1, a U.S. firm

Q46: Wolters Corporation is a U.S. corporation

Q47: Bulldog Enterprise, a U.S. firm, agreed on

Q48: On November 1, 20X1, a U.S. company

Q49: Describe the disclosures required by the FASB

Q50: On 7/1, a company forecasts the

Q55: The accounting treatment given a cash flow

Q68: Differentiate between the following monetary systems: floating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents